- by foxnews

- 11 May 2025

Danger and deja vu: what 2011 can tell us about the US debt ceiling crisis

Danger and deja vu: what 2011 can tell us about the US debt ceiling crisis

- by theguardian

- 01 May 2023

- in politics

You can be forgiven a sense of déja vu. This has all happened before. Only this time, it could be worse.

With stock markets reeling and 72 hours left before the US would have defaulted on its debts, a disaster that threatened to wreak havoc on the economy, Republicans and Democrats finally agreed on a bill that raised the debt ceiling by $900bn and cut spending by nearly the same amount.

For Republicans, particularly the new rightwing Tea Party members who refused to budge even as default loomed, it was a political win.

To some economists, that was just the short-term impact. The spending cuts ushered in years of budget tightening whose impacts were felt for years.

Government spending tends to rise after recessions but per-capita federal spending fell after the debt crisis. Bivens argues that if government spending had continued at its normal levels, the unemployment rate would have returned to its pre-recession level five or six years before 2017, when the job market finally recovered its losses.

The question now is: what are the political costs for the Democrats and Republicans? As the crisis deepens, how long will they hold and who will fold?

As in 2011, the two sides are locked in a game of chicken and waiting for the opposition to cave. If neither side blinks, the impact on the economy will be felt for years to come.

- by foxnews

- descember 09, 2016

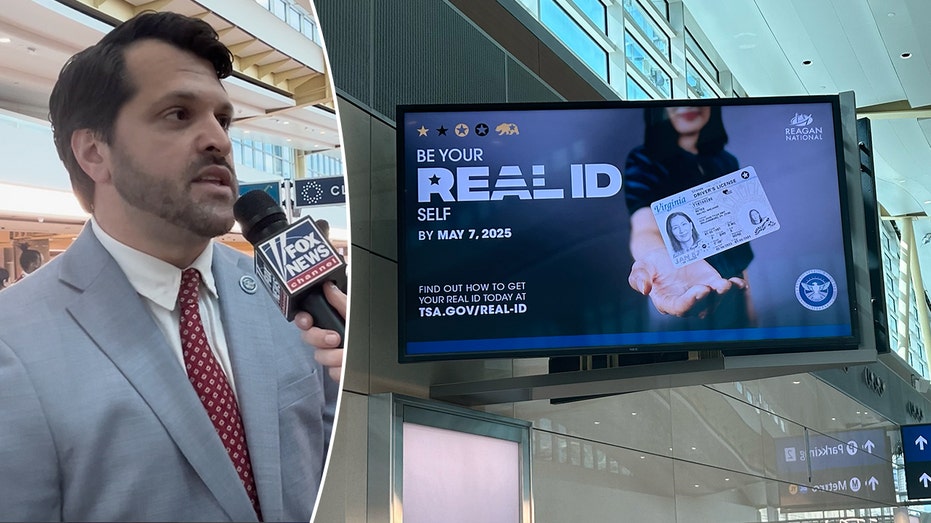

Hidden REAL ID hassles facing airline travelers and states to avoid

States vary in readiness for the May 7 REAL ID deadline. While some DMVs offer extended hours to accommodate demand, others face challenges with appointment availability as the date approaches.

read more